Nobody goes there anymore. It’s too crowded.

By John Lui –Managing Director and Chief Investment Strategist

In my last strategy piece, I warned people about the extreme momentum in Super Micro Computer Inc. (SMCI). People buying in March 2024 due to “fear of missing out” (FOMO) have a low probability of having a successful investment. Here is a chart of SMCI after it announced its latest quarterly earnings…

Source: CNBS dated 08/07/2024

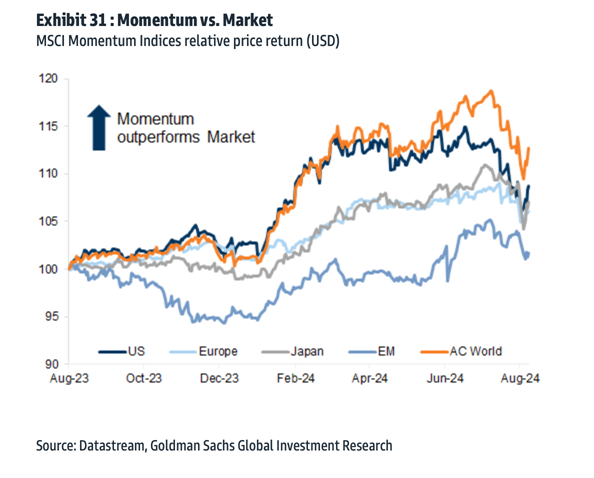

The momentum madness was not confined to just SMCI nor the Magnificent 7 tech stocks in the S&P 500 but was in fact a global mania as we saw on the Monday, August 5th, massive selloff.

Yes, the media is blaming the infamous “carry trade” of borrowing in low cost Japanese Yen to buy non Yen denominated assets, but that is just the financing part. The investment part into momentum assets (AI, semiconductors and tech) which is collapsing in value at a rate greater than your financing cost is rising, is the main culprit for this correction. In addition, a lot of FOMO buyers were not leveraged (didn’t borrowed to buy) and they just de-risked by selling.

When the de-risking of momentum plays occurs, momentum stocks may never get back to their previous peak price. Here is a chart of Cisco Systems. A FOMO investor buying the stock at its peak in 1999/2000 is still losing money 24 years later.

If you have any questions, please contact John or any of our advisors at (800) 472-8086.