Lui’s Lowdown on the Stock Market: Bad Breadth and Selfies

By John Lui - Chief Investment Strategist

The S&P 500 has a case of bad breadth as a few mega cap stocks dominated versus the average stock…

During the first half of 2024, the largest 7 stocks (Magnificent 7 or Mag 7) propelled the S&P 500, which is market cap weighted, to a return that was more than triple of the equal weighted S&P 500.

Nvidia is the Mag 1 and outperformed the other Mags by a wide margin…

Nvidia outperformed the S&P 500 by over 10 times during the first half of 2024.

Nvidia accounted for 33% of the S&P 500’s return…

Over the previous 8 years, the largest contribution averaged 8%, with only Apple’s 23% in 2020 coming close to Nvidia’s 33%.

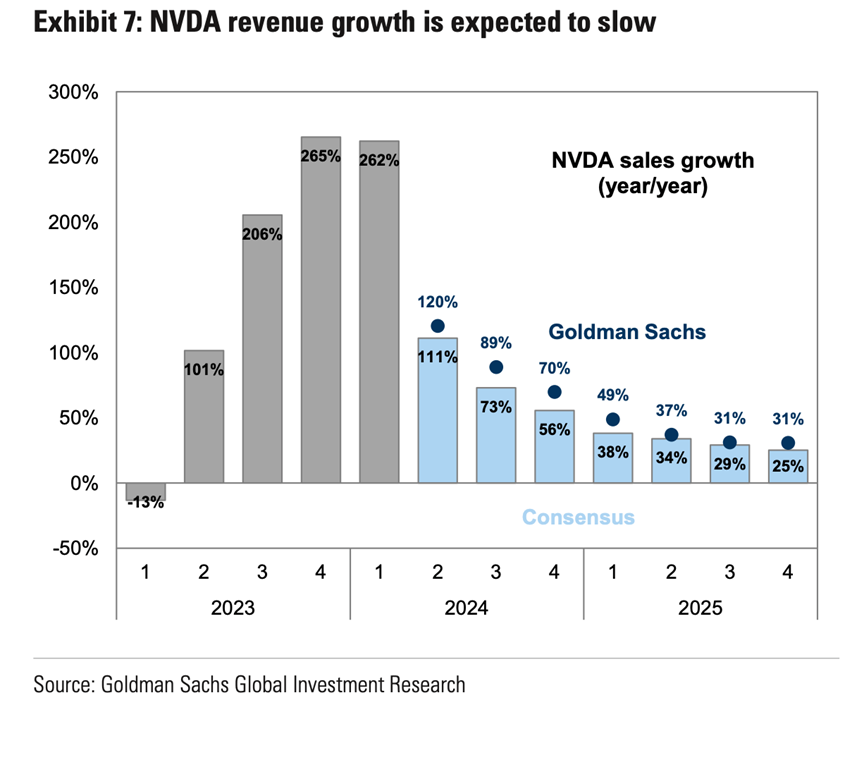

Nvidia’s revenue growth has peaked and will decelerate rapidly…

A prudent investor should be cautious on Nvidia’s stock as it is not likely to repeat its 2023 & 2024 spectacular outperformance with decelerating revenue growth.

Rise of the unloved in the 2nd half of 2024…

Source: Bespoke (as of October 2024)

The non-Mag 7/other 493 stocks in the S&P 500 have accounted for over 97% of the S&P 500’s gains for the 2nd half of 2024. The Mag 7 and Nvidia are treading water. Will they go under?

Let’s take a selfie before I answer that…

Here are the top selfie spots globally: Eiffel Tower (Paris), Burj Khalifa (Dubai), Disney World (Orlando), Taj Mahal (Agra), Big Ben (London), Sagrada Familia (Barcelona) and Colosseum (Rome). You can’t go wrong with any one of the Magnificent 7 Selfie Spots. Should you have budget constraints, you can do a cost analysis and start eliminating the most expensive destinations. Once you get down to the finalists, you can add qualitative factors to choose your ultimate destination.

When I construct the equity portion of my client’s portfolio, I go thru the same above process. Below are the Mag 7 stocks, the 7 largest companies by market capitalization (price of a share of stock times the number of shares outstanding) in the S&P 500. If I had $5 trillion, I could purchase any one of the Mag 7 and in return I would get all the revenues that company would generate. A useful valuation tool is to divide the prior 12 months revenue into the market cap, which is the Price/Sales ratio. The Price/Sales would give you the number of years it would take you to recover the purchase for the entire company. The Price/Sales does not take into account debt, cash and profitability. It is a quick and simple comparative tool to use.

I have calculated the Price/Sales of each Mag 7 so that I can determine what companies are the best to have a selfie (invest in).

None of the Mag 7 are cheap as they all have Price/Sales multiples of greater than 2. Amazon is the cheapest as I would recoup my purchase price in under 4 years. Nvidia is the most expensive and its Price/Sales is 8 times as much as Amazon’s. It would take me more than 30 years for me to get back my purchase price for Nvidia in revenues. In addition, Nvidia’s revenue growth has peaked, making it unlikely that its Price/Sales multiple will contract.

Nvidia’s Price/Sales is more than 2.3 times that of Microsoft. This is interesting as Microsoft is Nvidia’s largest client, making up about 20% of Nvidia’s revenues. In addition, Nvidia, is more expensive versus its other significant clients: Amazon, Alphabet, Meta and Tesla.

On a market cap basis, Nvidia is larger than any of its significant clients. Only Apple, which is not a client of Nvidia, has a larger market cap than Nvidia.

Will the Mag 7 tread water or go under…

Investors are embedding accelerating growth for the Mag 7 due to artificial intelligence (AI), hence the high Price/Sales multiples. I believe Apple, Microsoft, Amazon, Alphabet, and Meta’s revenues will be boosted by AI. They all have excellent client retention and a successful history of offering new added value services/products to their clients. I would take a selfie with all of them.

I do not understand Elon Musk and until I do, I will continue to think about taking a selfie with Tesla.

I would not take a selfie with Nvidia due to its high valuation and expected deceleration in revenue growth, but would reconsider it when its valuation becomes attractive.

Please reach out to your relationship manager and/or your portfolio manager if you have questions or concerns.

Disclosure

Chatham Wealth Management is registered as an investment adviser with the SEC. SEC registration does not constitute an endorsement of the firm by the Commission, nor does it indicate that the adviser has attained a particular level of skill or ability.

Past performance may not be indicative of future results. All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment or strategy will be profitable for a client's portfolio.